At Windfall, we work with 500+ nonprofits across the country. Since the COVID-19 pandemic started, there has been a lot of speculation about consumer behavior and how it will affect fundraising for the remainder of 2020 and any potential recovery in 2021. Given our unique vantage point, we wanted to provide insights on how prior economic recessions impacted nonprofit fundraising and how this potential downturn could be different.

This blog post follows a Windfall / APRA webinar from May 2020 where we covered:

- Potential economic recovery options and the impact to nonprofits

- Historical trends in individual nonprofit giving

- Giving / wealth versus the stock market

- How data-driven nonprofits should respond

If you want to listen to the full webinar, visit this link to access the on-demand recording.

Potential Economic Recovery Options & Impact to Nonprofits

Windfall’s mission is to determine the net worth of every person on the planet. With our mission in mind, the economic outlook and potential recovery is critical to our modeling efforts. We refresh our household dataset on a weekly cadence to capture both positive and negative changes in wealth.

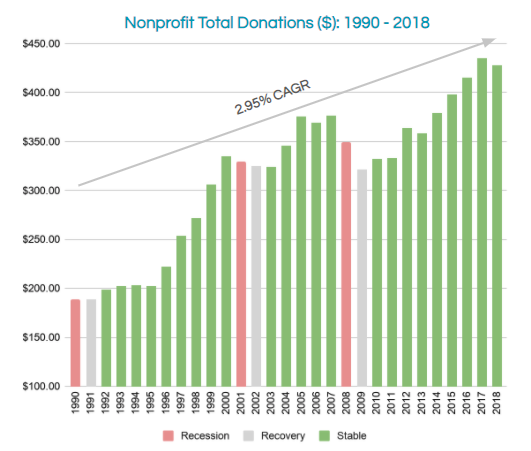

COVID-19’s dramatic impact on the US economy was extremely quick. Optimists made the “V-shaped” recovery popular as a way to indicate that the underlying economic environment is strong and unlike the 2008 great recession, there is currently not a fundamental issue with our financial system. Other shapes emerged as our understanding of the virus and its longer term impact evolved.

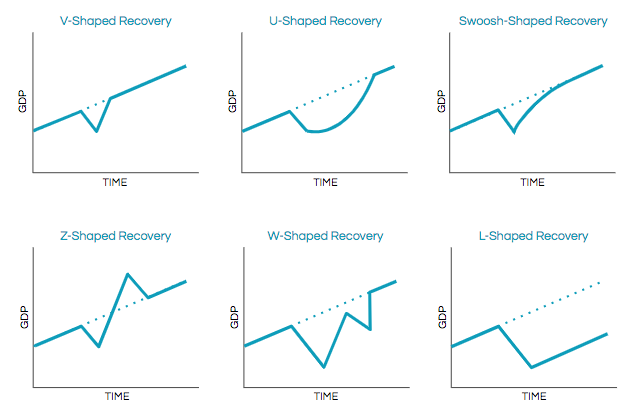

Even as we speculate on the potential recovery options, only time will dictate which shape we end up following. At Windfall, we have observed hundreds of conversations with nonprofits and categorized the responses across a spectrum of three categories:

- Dire Revenue Loss: These are nonprofits that have to shut their doors with shelter-in-place orders and rely on other revenue sources like: ticketing, elective surgeries, or selling physical goods.

- Stable but Cautious: These nonprofits have enough cash reserves to ride out the pandemic but are still concerned about fundraising over the next 18 months. Without galas or larger events, each dime is getting scrutinized heavily.

- Highlighted COVID-19 Need: If your nonprofit’s mission helps respond to COVID-19, you may see a dramatic increase in donations (medical research, food banks, etc). You have plenty of support (for now)

The classification above is agnostic to size / stage of the specific nonprofit and is meant to be illustrative. As we observe states reopening their economies, where a nonprofit falls on the spectrum may shift slightly. If there is a second outbreak of COVID-19, the economic impact to that nonprofit may be exacerbated.

While we spend time trying to predict the future, it may be helpful to analyze how nonprofit fundraising, and specifically individual fundraising, was impacted by prior recessions.

Historical Trends in Individual Nonprofit Giving

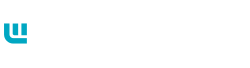

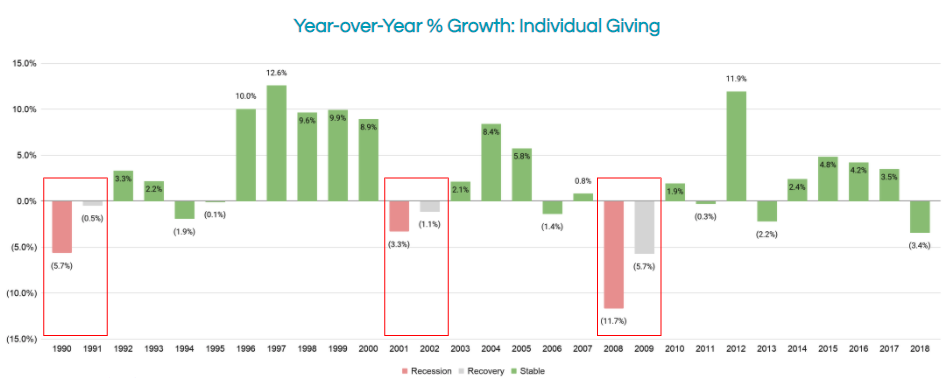

When we look at the past, there are a few things that we can glean from individual giving:

- We do not see everything grow in good times (some good years have declines)

- When there is a recession, individual giving does go down

- The year after a recession, when the economy is recovering, we still see declines in individual giving

As we can see from the chart above that outlines year-over-year growth in individual giving over the last three recessions, individual fundraising goes down in the year of a recession and continues to decline in the following year. If we maintain this trend for 2020, we can anticipate that individual giving will go down this year AND will decline further in 2021.

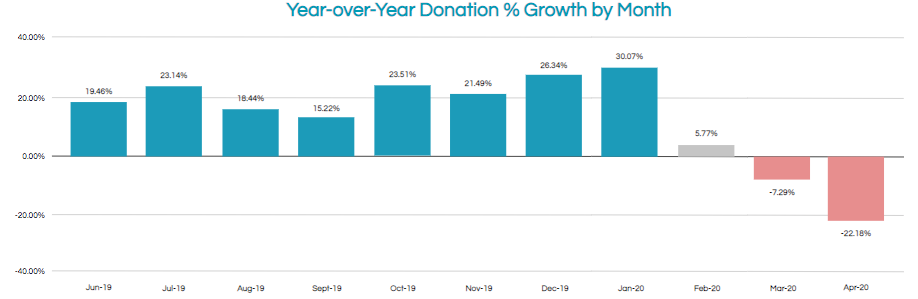

In fact, we surveyed 100 of our customers, who opted in for a benchmark study to understand how their giving compared to others around the country. Overall, we can see that nonprofit year-over-year donations in 2019 were strong compared to 2018, but starts to diminish in February 2020, with a fairly significant decline in April 2020:

On the surface, this looks fairly concerning. However, there are pockets of insights our customers found through this analysis that we’ll cover in the last section: how nonprofits should leverage data now more than ever.

Giving / Wealth Versus the Stock Market

Over the last few months, there has been a lot of emphasis on the stock market as an indicator of economic health. It certainly is a leading indicator, but it is only one of many that we should observe. In fact, Windfall wrote about the Stock Market’s Impact on Consumer Wealth in March 2020 to showcase how wealth does not necessarily correlate with the stock market.

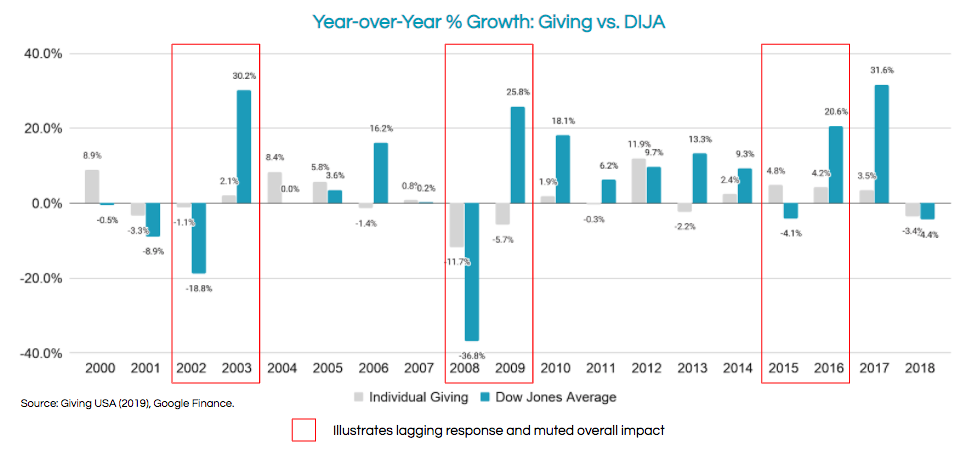

Even if the stock market’s fluctuation doesn’t impact wealth as much as we thought: does it impact individual giving?

In order to answer this question, we wanted to compare individual giving versus the Dow Jones Industrial Average (DJIA):

Here is some good and bad news from looking at this historical analysis:

- Good news: When the stock market recedes, individual nonprofit giving is less volatile

- Bad news: When the stock market rebounds, individual giving either (1) continues its decline or (2) has a muted increase

The data above is aggregated, so specific sectors may be impacted differently depending on the economic conditions. We are looking at the past to help us to grapple with the future impact to the overall industry, but it may not necessarily provide all the answers.

For example, given the potential recovery within 2020, there is a world where we live all of the recession / recovery cycles within one year. What does that mean for nonprofit fundraising professionals? It’s time to double-down on data to combat the headwinds ahead.

How Data-Driven Nonprofits Should Respond

In January, Windfall wrote a piece on the Top 5 Nonprofit Data & Machine Learning Trends for 2020. We highlighted five trends in that article:

- Traditional Gift Capacity Metrics Will Be Replaced

- Data Freshness Will Become the New Normal

- Fundraisers Will Pay More Attention to Existing Constituents

- Sophisticated Machine Learning Will Be Democratized

- Increased Political Contributions Will Signal Increased Nonprofit Fundraising

These trends appear to be holding true, even though we did not anticipate COVID-19 in January. Specifically, we found a few trends that we think may be helpful for other nonprofit professionals looking for new ideas to tackle their new reality.

Focus on High Net Worth HouseholdsHistorically, many nonprofits focused on gift capacity versus net worth. In the past there was not one vendor who owned their data or made it their mission to make accurate consumer financial data. Moreover, the prevalence of machine learning and data science tools were relatively nascent making this innovation much more difficult.

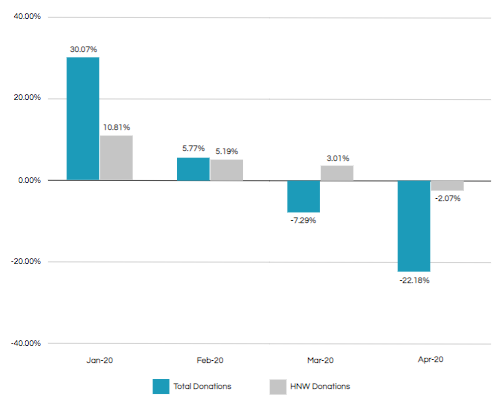

Windfall focuses on this problem and we analyzed the same data from 100 nonprofit customers to understand if high net worth ($1MM+) households were pulling back on their donations:

While the sample size is limited to 100 nonprofits, we can see that the fluctuations from high net worth donors was more stable than their counterparts. This means if nonprofits focus on their highest value prospects and donors, there may be a way to mitigate the loss in donations across the organization.

But, do you know your high net worth constituents? Windfall developed Windfall Wealth Analytics to help organizations answer this question. Understanding the wealth at a point in time is very helpful; however, it is only one part of the equation.

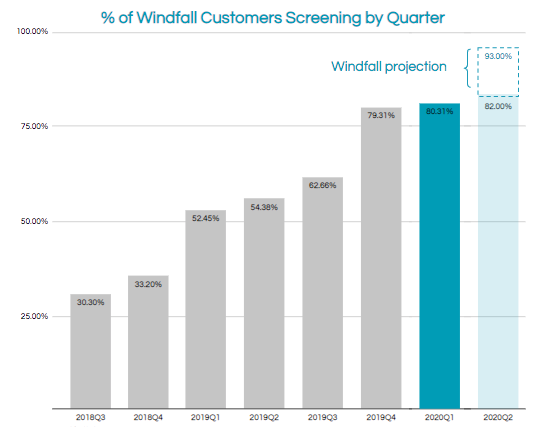

Data Freshness Provides an Unfair AdvantageWe foresaw that more organizations would try to take advantage of fresh data. At Windfall for example, we update our data every week. As we described earlier, we take into consideration wealth creation and destruction events so that our customers have the latest and greatest data. This is very unique across the industry and we have seen our customers take advantage pre- and post-COVID-19:

Overall, we have seen that most customers are syncing with our up-to-date dataset more frequently than 2 years ago. In fact, we have already surpassed our historical records of customer sync frequency and anticipate 90%+ of our customers will sync their data with us in Q2 2020.

While the historical norm was to wealth screen every three years (either due to cost, bandwidth, or lack of actionability), the new reality is that leveraging this data at least quarterly is a must for:

- Identifying and prioritizing your prospects / donors

- Understanding where there are pockets of opportunities

- Engaging with your prospects at the right time

Identifying, understanding, and engaging your prospects and donors is predicated on accurate data that updates in its entirety weekly (not just a handful of records). Nonprofits need to look at third party datasets and take advantage of any insights to cultivate and engage with top prospects.

Leveraging Machine Learning Amidst Constricting Budgets

Nonprofits are thirsting for machine learning solutions. There is no reason that nonprofits shouldn’t take advantage of new technologies that empower them to be stronger, faster, and more efficient.

Unfortunately, not all nonprofit machine learning is built the same way. You need to make sure that you have a good checklist put together:

- Is the model built for me or is it off the shelf for all customers?

- Is this just an RFM model or is the vendor taking a more sophisticated approach?

- How frequently do scores get refreshed? Does the model ever get retrained?

- What is the overall ongoing cost of ownership? Who helps me implement the solution?

Instead of hosting large galas or events, nonprofits are “stuck” with their existing constituent base. These individuals have already signaled affinity for your organization and potentially may be able to give more during these troubling times. Machine learning can help us focus on the right constituents rather than look outwards to the vast ocean where your team can spend a ton of bandwidth trying to understand where to “go next.”

At Windfall, we introduced our Propensity-to-Give product last year and have seen a rapid adoption of the product across our 500+ nonprofit customer base. The goal is to help democratize data science for all nonprofit organizations across the country.

Want to learn more about what we covered? View the recorded webinar through the link: Data-Driven Development in a Volatile Market On-Demand Webinar

Conclusion

The nonprofit ecosystem will be affected by the economic recession and most likely will still be feeling the effects during the recovery. By looking at the past three recessions, we can get a sense of how individuals’ behavior is impacted by a downturn. But this scenario is different and it’s difficult for us to get a sense of what will happen since there is no playbook.

Instead, we’ve found that successful nonprofits are facing their fundraising headwinds with a more comprehensive data-driven approach: up-to-date data and best-in-class machine learning. With the tools described in this post, teams can be more efficient in their outreach and development efforts.

To find out more about our services and how we may be able to help your organization, feel free to reach out to our team.

The analysis and article was co-authored by Arup Banerjee, CEO and Co-founder of Windfall, and Harry Morton, Data & Operations Analyst, using a combination of third-party research, internal metrics, and surveys.